Enhance Your Legacy With Specialist Count On Structure Solutions

In the world of heritage planning, the relevance of developing a strong structure can not be overstated. Specialist depend on structure remedies offer a durable structure that can secure your properties and ensure your wishes are executed exactly as intended. From lessening tax liabilities to picking a trustee that can competently handle your events, there are essential considerations that demand focus. The intricacies associated with trust structures necessitate a critical technique that lines up with your long-term goals and worths (trust foundations). As we explore the nuances of trust foundation remedies, we uncover the key elements that can strengthen your legacy and provide a long-term effect for generations ahead.

Benefits of Depend On Foundation Solutions

Count on structure remedies provide a robust framework for guarding properties and making sure lasting economic protection for people and companies alike. Among the primary advantages of count on structure options is possession protection. By establishing a count on, people can shield their assets from potential threats such as legal actions, lenders, or unpredicted monetary obligations. This defense ensures that the possessions held within the trust fund continue to be safe and secure and can be handed down to future generations according to the person's dreams.

Furthermore, trust fund structure options provide a tactical technique to estate preparation. Via depends on, individuals can describe just how their properties should be managed and distributed upon their death. This not just aids to stay clear of conflicts among beneficiaries however likewise makes certain that the person's heritage is preserved and managed efficiently. Counts on likewise use personal privacy advantages, as properties held within a trust fund are exempt to probate, which is a public and often lengthy legal process.

Sorts Of Trusts for Tradition Planning

When thinking about tradition planning, an important element includes checking out numerous kinds of lawful tools developed to maintain and disperse properties successfully. One typical sort of trust fund made use of in tradition planning is a revocable living trust fund. This trust fund enables individuals to keep control over their possessions during their life time while making certain a smooth shift of these assets to recipients upon their death, avoiding the probate procedure and offering privacy to the family.

An additional type is an irrevocable depend on, which can not be altered or withdrawed once developed. This count on supplies prospective tax obligation benefits and secures assets from lenders. Philanthropic trust funds are likewise prominent for individuals aiming to support a cause while maintaining a stream of income for themselves or their beneficiaries. Special needs depends on are important for people with impairments to guarantee they receive required treatment and assistance without jeopardizing federal government advantages.

Comprehending the different sorts of trust funds available for legacy preparation is crucial in establishing a detailed approach that aligns with private objectives and top priorities.

Picking the Right Trustee

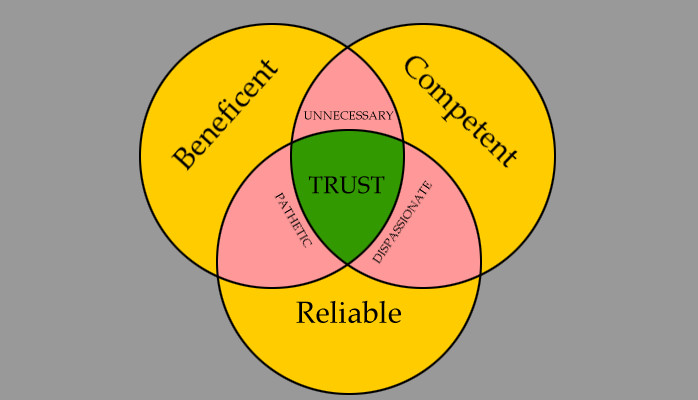

In the world of legacy planning, a vital element that requires cautious factor to consider is the option of an ideal person to accomplish the pivotal role of trustee. Choosing the best trustee is a decision that can considerably affect the successful execution of a depend on and the gratification of the grantor's dreams. When picking a trustee, it is necessary to focus on top qualities such as reliability, monetary acumen, stability, and more helpful hints a dedication to acting in the very best passions of the recipients.

Ideally, the chosen trustee needs to my blog have a strong understanding of monetary issues, be capable of making sound financial investment decisions, and have the capacity to browse intricate legal and tax demands. By meticulously considering these elements and choosing a trustee that straightens with the worths and objectives of the trust, you can assist make sure the lasting success and conservation of your heritage.

Tax Obligation Effects and Advantages

Considering the fiscal landscape surrounding count on structures and estate planning, it is vital to look into the intricate realm of tax implications and benefits - trust foundations. When establishing a count on, understanding the tax ramifications is vital for maximizing the advantages and lessening prospective obligations. Depends on supply numerous tax obligation advantages depending upon their structure and function, such as decreasing inheritance tax, earnings taxes, and gift taxes

One significant benefit of particular trust fund frameworks is the capacity to move possessions to recipients with decreased tax obligation repercussions. As an example, irreversible counts on can remove properties from the grantor's estate, possibly reducing inheritance tax obligation. Furthermore, some counts on permit revenue to be dispersed to beneficiaries, that might be in reduced tax obligation brackets, causing general tax financial savings for the family members.

Nevertheless, it is necessary to keep in mind that tax regulations are complicated and conditional, stressing the necessity of speaking with tax specialists and estate planning specialists to guarantee conformity and make best use of the tax advantages of count on structures. Properly browsing the tax obligation ramifications of trust funds can result in substantial savings and a much more efficient transfer of riches to future generations.

Actions to Establishing a Depend On

To develop a count on efficiently, precise interest to information and adherence to legal methods are crucial. The very first step in developing a trust fund is to clearly specify the purpose of the count on and Clicking Here the possessions that will certainly be consisted of. This involves determining the recipients that will certainly gain from the count on and assigning a reliable trustee to manage the assets. Next, it is vital to pick the sort of trust that finest lines up with your objectives, whether it be a revocable depend on, unalterable trust fund, or living trust.

Final Thought

Finally, establishing a trust structure can supply various benefits for heritage planning, including property security, control over distribution, and tax obligation advantages. By selecting the appropriate sort of depend on and trustee, individuals can guard their possessions and ensure their dreams are accomplished according to their desires. Recognizing the tax effects and taking the needed steps to develop a count on can aid enhance your legacy for future generations.